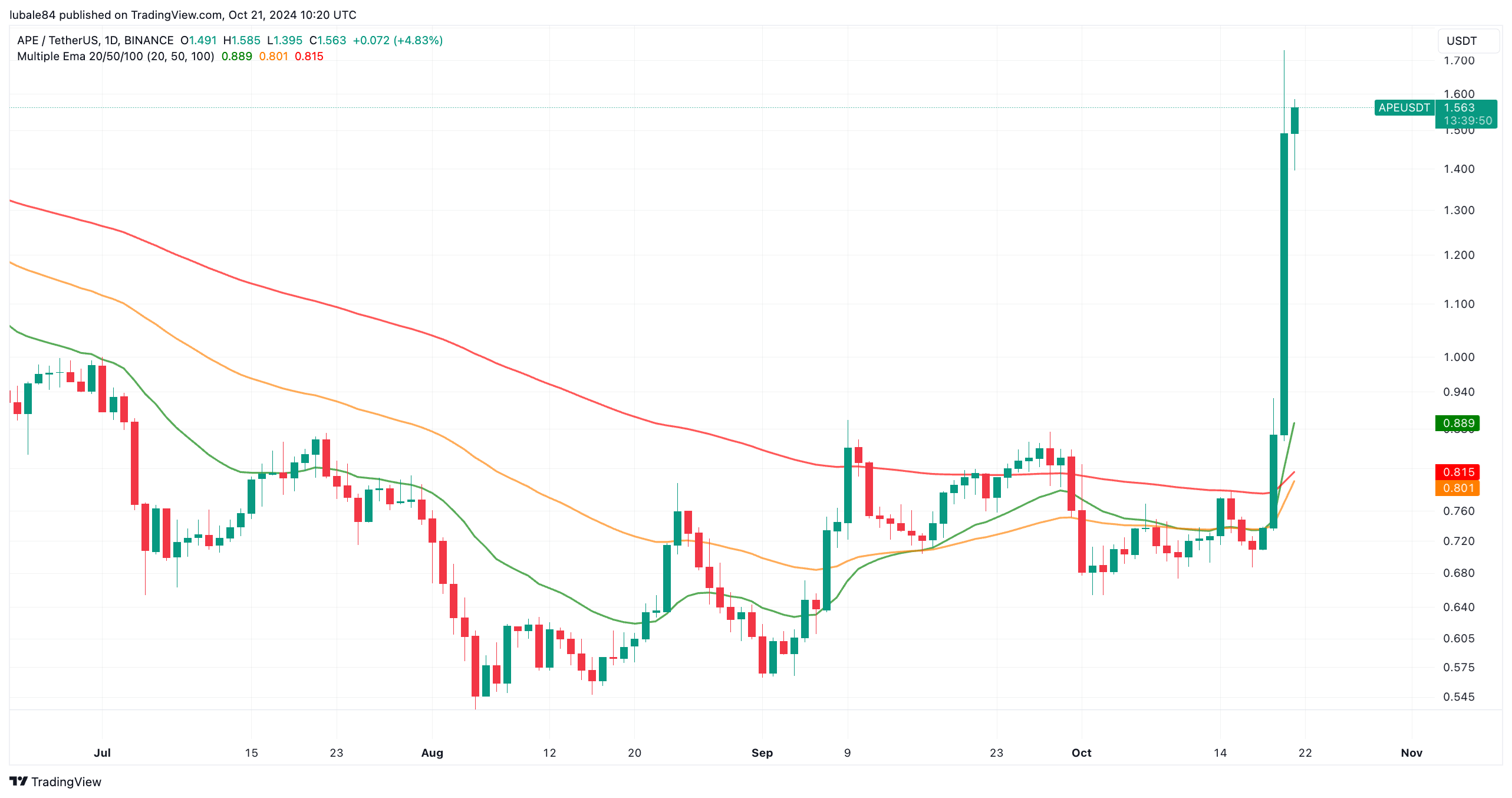

ApeCoin (APE) has surged 130% over the past four days due to excitement surrounding the launch of the ApeChain network.

On October 21, APE reached a six-month high of $1.75, up from $0.861 on October 20. Currently, APE is trading at $1.53, marking a 16.5% increase over the past 24 hours and a 125% rise over the past week.

Several factors behind ApeCoin’s price rally include developments around the newly launched ApeChain and a strengthening market structure.

Launch of Layer 3 ApeChain Drives APE’s Price

ApeCoin’s price surged on October 21 following the launch of the ApeChain blockchain by Yuga Labs.

ApeChain, a Layer 3 blockchain, officially went live on October 20, allowing the transfer of APE, WETH, USDC, USDT, and DAI tokens between ApeChain, Ethereum, and Arbitrum.

The launch of ApeChain has expanded APE’s utility within the Yuga Labs ecosystem, which could increase demand for the ApeCoin token. As a result, APE’s trading volume has surged, spiking by more than 250%, according to data from Santiment.

ApeCoin’s rally is also driven by the integration of LayerZero’s Omnichain Fungible Token (OFT) standard into ApeChain. LayerZero allows APE to function as the governance token for ApeCoin DAO and be used for transaction fees across multiple blockchains.

Can ApeCoin Sustain Its Momentum?

ApeCoin’s recent price surge has attracted investors fearing they might miss out (FOMO). Anonymous trader Laxman suggests that “real” gains will come when APE closes the month above $1.99. Trader CryptoBull_360 predicts APE’s price could rise 260% to $2.75, driven by continued demand in the NFT market.

ApeCoin’s Relative Strength Index (RSI) is at 88, signaling overbought conditions and a potential price correction. However, data shows that APE has strong support.

The IOMAP model indicates that over 23.1 million APE were purchased at the $1.45-$1.49 price range, and buying pressure from this group could help push the price higher.

The IOMAP chart shows that APE faces little resistance on its upward path. However, a liquidation level to watch is $1.65, where leveraged derivatives traders may trigger liquidations. If APE reaches $1.65, it could lead to $8.63 million in short position liquidations.